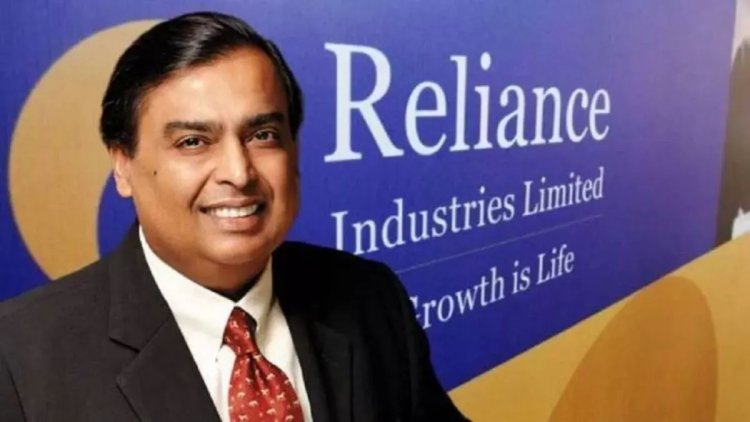

RIL Shares Surge, Reach New Highs: Understanding the Rally

Reliance Industries (RIL) saw a significant increase in its share value, rising by over 4.5% and reaching a new high of Rs 2,755 on the BSE exchange.

Reliance Industries (RIL) saw a significant increase in its share value, rising by over 4.5% and reaching a new high of Rs 2,755 on the BSE exchange. This surge was a result of RIL's decision to demerge its financial services arm, Reliance Strategic Investments, which will be renamed as Jio Financial Services (JFSL). The demerger is scheduled to take place on July 20, and the announcement was made after obtaining regulatory approval.

RIL's shares were actively traded and influenced the performance of the S&P BSE Sensex and Nifty50 indices. This demerger will unlock value for RIL's large shareholder base, benefiting the company's position as India's largest corporation by market capitalization. Under the demerger plan, RIL shareholders will receive one share of Jio Financial for each share they own in RIL. Over the past three months, RIL's stock has already risen by 13%.

RIL stated in a regulatory filing that July 20, 2023, has been designated as the record date to determine the equity shareholders eligible to receive the new shares of the resulting company. The demerger scheme's effective date is July 1.

In a separate development, Reliance Retail, a subsidiary of RIL and India's largest retailer, announced a reduction in its equity share capital. This decision was approved by Reliance Retail's board and involves extinguishing or canceling the company's stock, except for the shares owned by its holding company, Reliance Retail Ventures. The valuation for this reduction will be determined by independent registered valuers, and the price set for each share is Rs 1,362.

Reliance Retail Ventures currently holds approximately 99.91% of Reliance Retail, while the remaining 0.09% is held by other shareholders, according to a source familiar with the matter.

What's Your Reaction?